In today’s digital marketplace, a robust online presence is crucial for business success. For e-commerce businesses, this translates to having a seamless and secure checkout process. A key component of this process is the payment gateway. This comprehensive guide will delve into the world of payment gateways, providing you with the knowledge to choose the right one for your business, optimize your checkout experience, and ultimately unlock e-commerce success. We will explore the various types of payment gateways, discuss key features and benefits, and provide practical advice on integrating them effectively into your e-commerce platform.

Choosing the right payment gateway can be the difference between thriving and simply surviving in the competitive world of e-commerce. This guide will equip you with a comprehensive understanding of payment gateway functionality, security considerations, and the latest industry trends. From understanding transaction fees and processing times to navigating security protocols like PCI DSS compliance, we’ll cover everything you need to know to make informed decisions and maximize your e-commerce success with the perfect payment gateway solution.

What is a Payment Gateway?

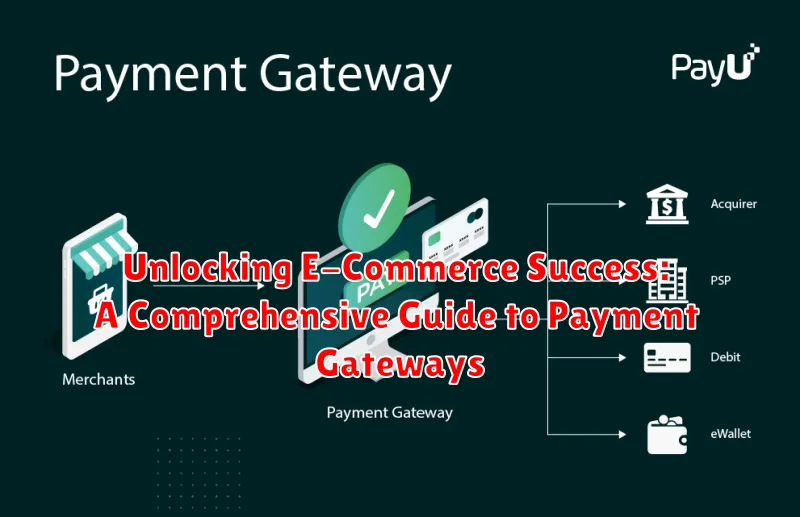

In the realm of e-commerce, a payment gateway serves as the crucial link between your online store and the financial networks that process customer payments. Think of it as the digital equivalent of a physical point-of-sale terminal you’d find in a brick-and-mortar store.

A payment gateway securely authorizes and transfers payment information from the customer to the merchant’s acquiring bank. It facilitates the transfer of funds for online purchases, ensuring a smooth and secure transaction for all parties involved. Security is paramount in this process, and payment gateways utilize encryption and other security protocols to protect sensitive data.

By utilizing a payment gateway, businesses can accept various payment methods, including credit cards, debit cards, and sometimes alternative payment options like e-wallets. This streamlined process enables businesses to efficiently process transactions and manage their online sales.

How Payment Gateways Work

Payment gateways facilitate online transactions by acting as a secure bridge between your customer, your online store, and the payment processor. Think of it as the digital equivalent of a physical point-of-sale terminal.

When a customer completes a purchase on your website, the payment gateway securely captures their payment information. This information is then encrypted and transmitted to the payment processor for authorization.

The payment processor communicates with the customer’s issuing bank to verify the funds. Once approved, the processor sends a confirmation back to the payment gateway, which then relays this information to your website, allowing the transaction to be completed.

This entire process happens within seconds, providing a seamless checkout experience for your customers. Security is paramount, and payment gateways utilize advanced encryption methods to protect sensitive data throughout the transaction process.

Types of Payment Gateways

Payment gateways generally fall into a few key categories, each with its own set of characteristics and functionalities.

Hosted Payment Gateways

With hosted gateways, the customer is redirected to a third-party payment page to complete their transaction. This removes some PCI compliance burden from the merchant. Examples include PayPal and Stripe Checkout.

Self-Hosted Payment Gateways

These gateways allow customers to complete their purchase on the merchant’s website. While offering a more seamless experience, self-hosted solutions require greater attention to security and PCI DSS compliance. Examples often involve integrating with APIs and handling sensitive data directly.

Direct Payment Gateways

Direct payment gateways connect directly to a payment processor, facilitating transactions without redirects. This option often requires a merchant account and can provide greater control over the payment process. Examples include Authorize.Net and Braintree.

Local Bank Integrators

These gateways integrate directly with local banks and are often specific to a particular region or country. They can streamline transactions for customers using those banks. Choosing a local bank integrator depends on the target market and its preferred payment methods.

Choosing the Right Payment Gateway for Your Business

Selecting the right payment gateway is a crucial decision for any e-commerce business. The ideal gateway aligns with your specific needs and contributes to a seamless customer experience.

Several factors influence this choice. Business size and transaction volume play a significant role. A small business with low sales might benefit from a simpler, less expensive solution, while a large enterprise requires a robust gateway capable of handling high volumes. Target market location is another important consideration. If you sell internationally, you need a gateway that supports multiple currencies and international payment methods.

Industry-specific regulations can also impact your choice. Businesses dealing with sensitive data might need a gateway with advanced security features to ensure compliance. Lastly, integration with your existing e-commerce platform is essential for streamlined operations. Ensure the gateway is compatible with your website and other business tools.

By carefully evaluating these factors, you can select a payment gateway that optimizes your business processes and enhances customer satisfaction.

Key Features to Look for in a Payment Gateway

Selecting the right payment gateway is crucial for a successful e-commerce business. Consider these key features when making your decision:

Security

Security is paramount. Look for features like PCI DSS compliance, tokenization, and fraud prevention tools to protect sensitive customer data.

Supported Payment Methods

Offer a variety of payment options to cater to a wider customer base. Ensure the gateway supports major credit cards, debit cards, and popular digital wallets.

Transaction Fees

Understand the transaction fee structure. Consider factors like per-transaction fees, monthly fees, and any additional charges for specific features or services.

Integration and Compatibility

Seamless integration with your existing e-commerce platform is essential. Check for compatibility with your shopping cart software and other business tools.

Customer Support

Reliable customer support is vital for troubleshooting any issues that may arise. Look for gateways that offer responsive support via multiple channels like phone, email, or chat.

Benefits of Using a Payment Gateway

Integrating a payment gateway offers numerous advantages for e-commerce businesses. Improved customer experience is a key benefit, enabling seamless and convenient transactions. Customers can choose their preferred payment method, leading to higher conversion rates.

Enhanced security is another crucial advantage. Payment gateways adhere to strict security standards, protecting sensitive customer data and reducing the risk of fraud. This builds trust and encourages repeat business.

Increased efficiency is also a significant benefit. Automated payment processing streamlines operations, reducing manual intervention and saving valuable time. This allows businesses to focus on other essential aspects of their operations.

Finally, using a payment gateway offers expanded market reach. By accepting various payment methods, businesses can cater to a wider audience, including international customers, unlocking global growth potential.

Integrating a Payment Gateway into Your E-Commerce Platform

Integrating a payment gateway is crucial for processing transactions on your e-commerce platform. The integration process typically involves several key steps.

First, select a payment gateway that aligns with your business needs and technical requirements. Consider factors such as transaction fees, supported currencies, and security features.

Next, sign up for an account with your chosen provider. This usually involves providing business information and verifying your identity.

After account creation, you’ll need to install and configure the payment gateway’s software or API on your platform. This might involve adding code snippets to your website or utilizing plugins provided by the gateway.

Testing is essential after integration. Conduct thorough tests to ensure all transactions are processed correctly and securely. This includes testing various payment methods and scenarios.

Finally, go live and start accepting payments. Monitor transactions closely for any issues and ensure seamless operation.

Security Considerations for Payment Gateways

Security is paramount when choosing and implementing a payment gateway. Protecting sensitive customer data should be a top priority.

Look for gateways that comply with the Payment Card Industry Data Security Standard (PCI DSS). This standard ensures the secure handling of credit card information.

Encryption is essential. Ensure your chosen gateway uses robust encryption methods to protect data during transmission.

Tokenization replaces sensitive card details with unique tokens, adding an extra layer of security. Consider gateways that offer this feature.

Fraud prevention tools are crucial. Look for gateways that offer features like address verification, 3D Secure authentication, and fraud scoring.

Regular security audits and vulnerability assessments are essential for maintaining a secure payment environment.

Common Payment Gateway Issues and Troubleshooting

Even with the most reliable payment gateways, occasional issues can arise. Understanding common problems and their solutions is crucial for maintaining a smooth checkout process.

Common Issues

- Declined Transactions: This can occur for various reasons, such as insufficient funds, incorrect card details, or security flags. Encourage customers to double-check their information. Address potential security concerns with the gateway provider.

- Authorization Failures: These can stem from issues with the customer’s bank or the payment gateway itself. Ensure your gateway settings are correctly configured and advise customers to contact their bank if the problem persists.

- Connectivity Problems: Network outages can disrupt transactions. Verify your internet connection and contact your gateway provider if the issue lies on their end.

Troubleshooting Tips

Check Gateway Logs: Review your payment gateway logs for detailed error messages. These can provide valuable insights for identifying the root cause of the problem.

Contact Support: Don’t hesitate to reach out to your payment gateway’s support team for assistance. They are equipped to handle technical issues and provide guidance.

Test Transactions: Regularly conduct test transactions to ensure your payment gateway is functioning correctly and to catch potential issues early.