In today’s digital marketplace, e-commerce success hinges on building and maintaining customer trust. A crucial component of this trust is ensuring the security of sensitive customer data, especially payment information. This is where PCI DSS compliance, the Payment Card Industry Data Security Standard, comes into play. PCI compliance isn’t merely a technical checklist; it’s a fundamental business imperative for any organization processing, storing, or transmitting cardholder data. Failing to meet these standards can result in significant fines, reputational damage, and loss of customer confidence, ultimately hindering your e-commerce success. This guide will provide you with the necessary information to navigate the intricacies of PCI compliance and fortify your online business.

Whether you’re a seasoned online retailer or just starting your e-commerce journey, understanding and implementing PCI DSS requirements is paramount. This comprehensive guide will demystify the twelve key requirements of PCI compliance, offering practical advice and strategies to protect your customers’ data and safeguard your business. From implementing strong access control measures and maintaining a secure network to regularly monitoring and testing your security systems, we’ll cover the essential steps you need to take to achieve and maintain PCI compliance, ultimately unlocking the path to sustainable e-commerce success.

Understanding PCI Compliance and Its Importance

PCI DSS, or the Payment Card Industry Data Security Standard, is a set of security standards designed to protect cardholder data and reduce the risk of credit card fraud. It applies to any business that accepts, processes, stores, or transmits credit card information.

Maintaining PCI compliance is not just a recommendation, but a requirement for all businesses handling card payments. Compliance validates your commitment to securing sensitive customer data, building trust and credibility with customers and partners.

Failure to comply can result in significant penalties, including fines, increased transaction fees, and even the revocation of your ability to process card payments. More importantly, a data breach can severely damage your reputation and erode customer confidence.

Data Breaches and Their Devastating Impact on E-Commerce

Data breaches pose a significant threat to e-commerce businesses, leading to severe consequences that can impact every facet of an organization. A breach occurs when sensitive customer information, such as credit card numbers, names, addresses, and other personally identifiable information (PII), is accessed or stolen by unauthorized individuals or entities.

The impact of a data breach can be catastrophic, both financially and reputationally. Financial losses can stem from direct costs like regulatory fines, legal fees, and compensation to affected customers. Indirect costs, often more substantial, include damage to brand reputation, loss of customer trust, and decreased sales.

Reputational damage is a particularly devastating consequence. Consumers are increasingly concerned about data privacy and security, and news of a breach can quickly erode trust and loyalty. This can lead to long-term damage to brand image and a decline in customer base.

Furthermore, data breaches can expose businesses to legal and regulatory penalties. Non-compliance with data security standards like PCI DSS can result in hefty fines and legal action. In some cases, businesses can even face criminal charges.

Key Requirements of PCI DSS

The Payment Card Industry Data Security Standard (PCI DSS) outlines twelve core requirements for securing cardholder data. These requirements are grouped into six logical groups called control objectives.

Build and Maintain a Secure Network: This involves installing and maintaining a firewall configuration to protect cardholder data, and not using vendor-supplied defaults for system passwords and other security parameters.

Protect Cardholder Data: This focuses on protecting stored cardholder data and encrypting transmission of cardholder data across open, public networks.

Maintain a Vulnerability Management Program: Regularly update anti-virus software or programs and develop and maintain secure systems and applications.

Implement Strong Access Control Measures: Restrict access to cardholder data by business need-to-know, assigning a unique ID to each person with computer access, and restricting physical access to cardholder data.

Regularly Monitor and Test Networks: Track and monitor all access to network resources and cardholder data and regularly test security systems and processes.

Maintain an Information Security Policy: Maintain a policy that addresses information security for all personnel.

Steps to Achieve PCI Compliance for Your Online Store

Achieving PCI compliance requires a structured approach. Follow these steps to strengthen your security posture and protect cardholder data:

1. Assess Your Current Environment

Identify all systems, applications, and processes that handle cardholder data. This will help you determine the scope of your compliance efforts.

2. Implement Security Measures

Install and maintain a firewall, use strong passwords, and encrypt cardholder data transmission and storage. Regularly update your software and security systems.

3. Conduct Regular Vulnerability Scans

Perform regular vulnerability scans to identify and address potential weaknesses in your security infrastructure.

4. Document Your Policies and Procedures

Maintain detailed documentation of your security policies, procedures, and incident response plan.

5. Monitor and Test Your Systems

Regularly monitor and test your security systems to ensure they are functioning effectively. This includes penetration testing and vulnerability assessments.

6. Complete the Self-Assessment Questionnaire (SAQ)

Complete the appropriate SAQ based on how your business processes payments. This questionnaire documents your compliance efforts.

7. Submit Compliance Documentation

If required by your acquiring bank or payment brand, submit your compliance documentation to a Qualified Security Assessor (QSA) for review and validation.

Choosing the Right PCI Compliant Payment Gateway

Selecting a PCI compliant payment gateway is crucial for securing your customers’ payment information and maintaining the integrity of your online store. The right gateway will simplify your compliance efforts and reduce your risk of data breaches.

When evaluating payment gateways, consider the following key factors:

- Security features: Look for features like tokenization, encryption, and fraud prevention tools.

- Integration: Ensure seamless integration with your existing e-commerce platform.

- Scalability: Choose a gateway that can handle your current and future transaction volume.

- Pricing and fees: Understand the transaction fees, setup costs, and any other associated expenses.

- Customer support: Reliable customer support is essential for troubleshooting any issues.

By carefully considering these factors, you can choose a PCI compliant payment gateway that protects your business and your customers.

Maintaining PCI Compliance: Ongoing Efforts

Achieving PCI compliance is not a one-time event; it requires ongoing vigilance and effort. Regular monitoring and maintenance are crucial to ensuring your security posture remains strong and compliant.

Vulnerability scanning should be conducted periodically to identify and address potential security weaknesses. These scans can be performed by an Approved Scanning Vendor (ASV). Additionally, penetration testing, which simulates real-world attacks, can help uncover vulnerabilities that automated scans might miss. These security measures provide valuable insights into your system’s defenses.

Security awareness training for employees is essential. Staff should be educated on best practices for handling sensitive customer data, recognizing phishing attempts, and other security threats. Regular training reinforces the importance of security protocols and helps build a strong security culture.

Finally, maintaining up-to-date system patching and software updates is critical. This ensures that known vulnerabilities are addressed promptly, reducing the risk of exploitation. Regularly review and update your security policies and procedures to reflect changes in your business and evolving threats.

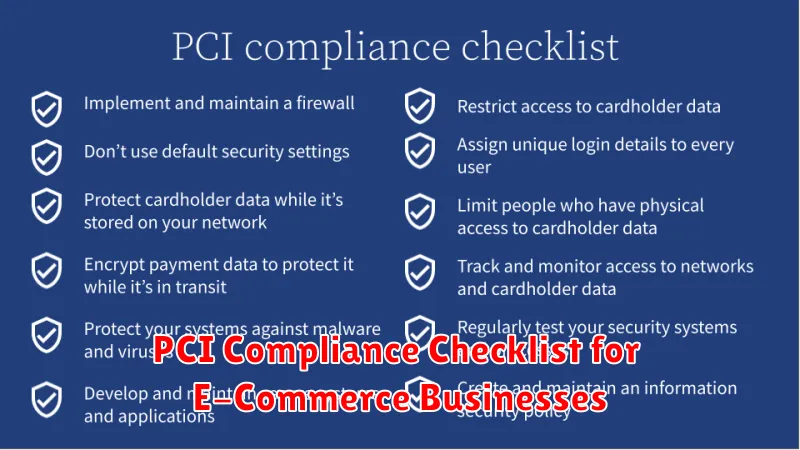

PCI Compliance Checklist for E-Commerce Businesses

Maintaining PCI compliance requires ongoing diligence. Use this checklist as a starting point to ensure your business adheres to the necessary security standards.

Network Security

- Install and maintain a firewall to protect cardholder data.

- Do not use vendor-supplied defaults for system passwords and other security parameters.

Protecting Cardholder Data

- Protect stored cardholder data. Encrypt transmission of cardholder data across open, public networks.

- Develop and maintain secure systems and applications.

Vulnerability Management

- Use and regularly update anti-virus software or programs.

- Develop and maintain secure systems and applications.

Strong Access Control Measures

- Restrict access to cardholder data by business need-to-know.

- Assign a unique ID to each person with computer access.

Regular Monitoring and Testing

- Track and monitor all access to network resources and cardholder data.

- Regularly test security systems and processes.

Maintain an Information Security Policy

- Maintain a policy that addresses information security for all personnel.

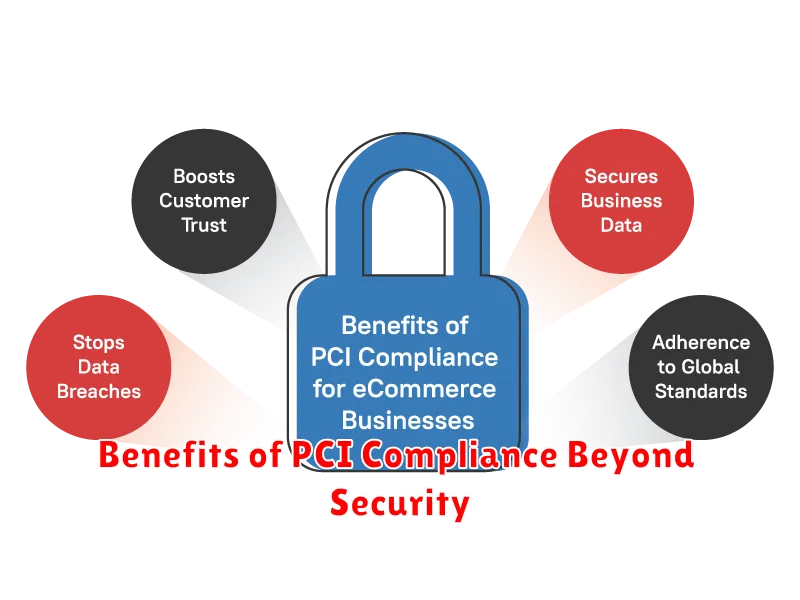

Benefits of PCI Compliance Beyond Security

While security is a primary driver for PCI compliance, adhering to these standards offers several additional advantages that contribute to overall business health and success.

Improved Reputation and Customer Trust: Demonstrating PCI compliance builds trust with customers. It assures them that their sensitive payment information is handled securely, fostering confidence in your brand and encouraging repeat business.

Reduced Risk of Financial Penalties: Non-compliance can result in significant fines, penalties, and increased transaction fees. Maintaining compliance mitigates these financial risks, protecting your bottom line.

Better Relationships with Payment Processors and Banks: Compliance strengthens relationships with payment processors and acquiring banks. It demonstrates your commitment to secure payment processing, making you a more desirable partner.

Streamlined Audit Processes: Adhering to PCI DSS establishes a framework for secure data handling. This simplifies audits, reducing the time and resources required for compliance validation.